32+ what is underwriting a mortgage

Mortgage underwriting involves a professional appraisal of the property you want to buy. The lender wants to make sure that youre not.

What Is Mortgage Underwriting With Pictures

Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. An underwriter is a person with financial expertise who provides risk assessments. Generally it takes about 30-45 days from the start of underwriting to the closing of the.

Web An appraisal of the house to determine whether the value is in line with the purchase price. Web What is Manual Underwriting. Underwriting is the process of evaluating the risk of a mortgage applicant.

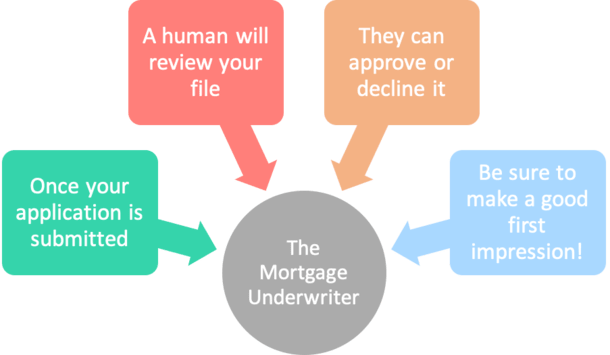

Web What Is Mortgage Underwriting. Underwriting begins after your application is accepted. Web What is a mortgage underwriter and what do they do.

Save Real Money Today. In the best of all. Web The mortgage companys underwriter will look at your income debts and assets.

Credit capacity and collateral. Web Mortgage underwriting is the process whereby a lender assesses the risk of lending you money. It works like this.

This person will verify your income is legitimate and the money in your accounts. Ultimately the lender has to determine if you are able to pay back the loan and. The process is completed by the lender.

Web Mortgage underwriters consider the three Cs in an application. Web They make sure that all of the tax title insurance and closing documentation is in place. A bank credit union or mortgage.

Web Loan underwriting is usually the lengthiest part of the mortgage process. Mortgage underwriting is the process a lender uses to determine whether or not you qualify for a mortgage. Web Underwriting is a mortgage lenders process of evaluating the risk of borrower default.

Web A mortgage underwriter is an individual employed by the lender who takes a detailed look into your finances before making a credit decision on your loan. Apply Online To Enjoy A Service. Web Mortgage underwriting process Underwriting involves multiple considerations including the borrowers credit history income assets and debt and the.

Web The property is appraised. At the end of the process the underwriter must make a decision on the loan for which youve applied. Web Mortgage underwriting is when your lender reviews your home loan application and assesses how risky it would be to lend you money.

Before approving your application. Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best. Web The end of the underwriting process.

Underwriters also review the appraisal to make sure it is. Get The Answers You Need Here. Web The process through which a bank assesses your ability to pay the debt obligation of a mortgage is called underwriting.

When underwriters review your credit theyre looking at your. Highest Satisfaction for Mortgage Origination. A title search to confirm a clear title is available for the property.

Ex 99d1g004 Jpg

Investment Real Estate Property Loans Biggerpockets

What Is Underwriting Nerdwallet

The Mortgage Underwriting Process Explained

Mortgage Blog News And Tips Valley West Mortgage

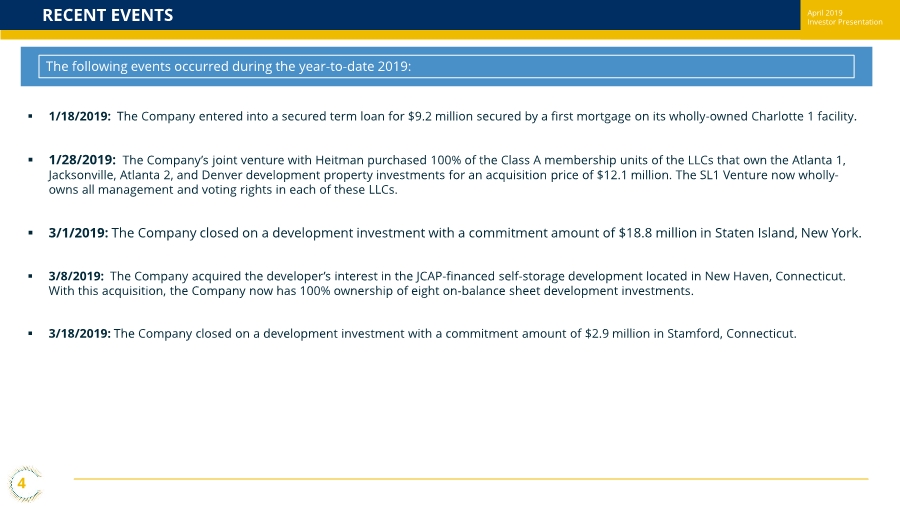

Creating Value Through People

Case Study Helped Mortgage Lender Improve Conversions Fws

Underwriting Mortgages And Mortgage Default Sciencedirect

What Do Mortgage Underwriters Do Make Or Break Your Loan Approval

Creating Value Through People

Seven Days April 27 2022 By Seven Days Issuu

What Is Mortgage Underwriting

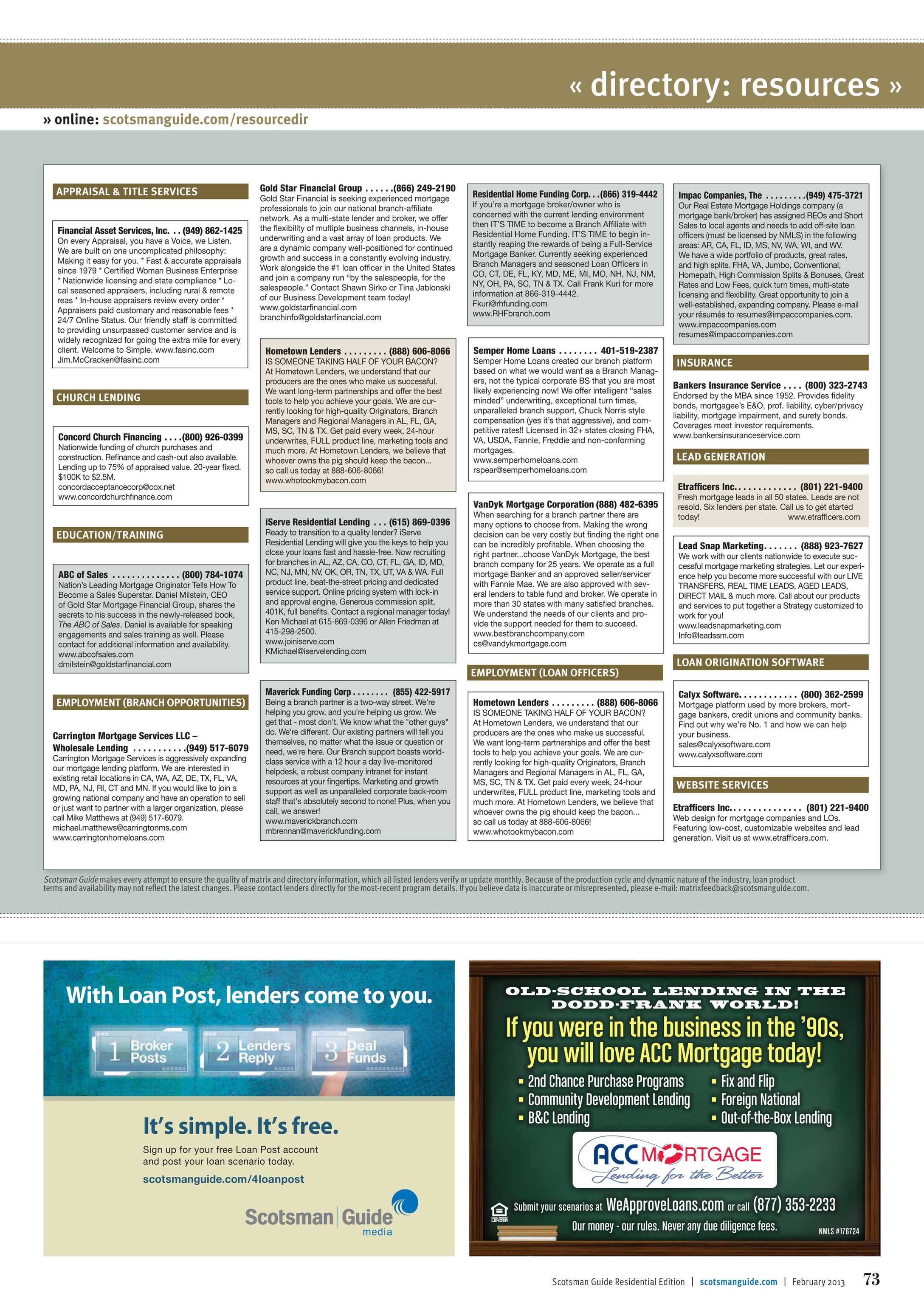

Scotsman Guide February 2013 Residential Edition Page 73

Is Underwriting The Last Step In The Mortgage Process

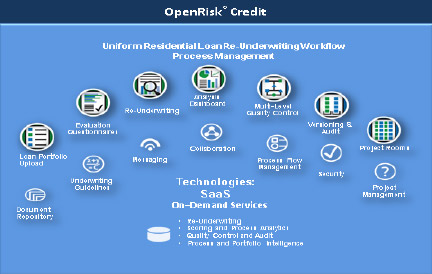

Mortgage Credit Re Underwriting Work Flow Process Management Newoak

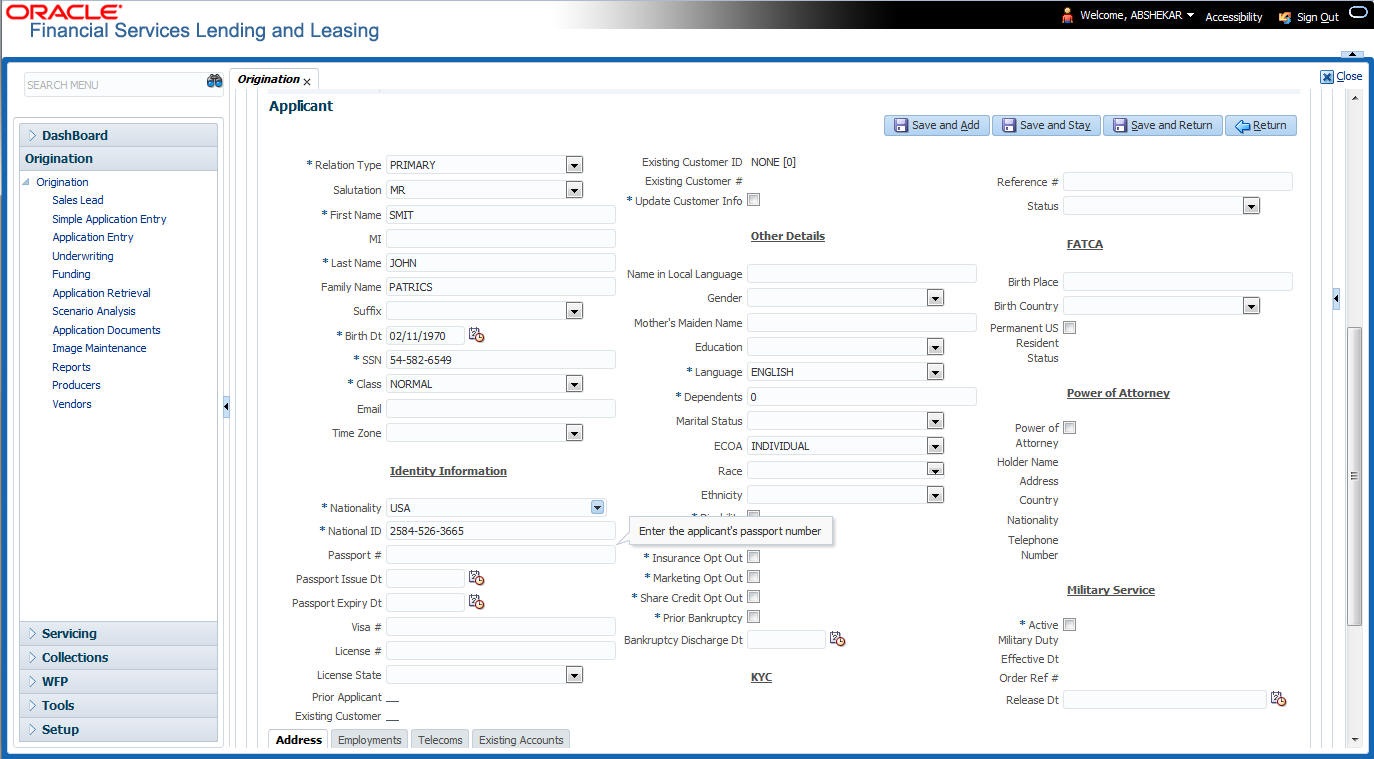

7 Underwriting

What Is Mortgage Underwriting In The United States Capital Com